Finishing a year in Venture Capital

From a rookie to an insider : A year of learning and unlearing !

"Venture Capital is about supporting innovation, embracing risk, and betting on the future." - John Doerr

How I got on this wild ride of Venture Capital: FOMO X Money

I first learned about Venture Capital in 2017 (third year of college), in an interview of David Rubenstein with SoftBank’s Masayoshi Son, where he had launched the biggest fund of all time - The $100Bn Vision Fund. Honestly, I was extremely impressed by Masa Son’s boldness and audacious nature, to the extent that I had made a 10-12-year-long plan to work in different industries and then launch my own fund in my thirties.

I graduated in 2018 and worked with IndigoEdge (a technology Investment Bank), where one of the co-founding partners, Zerin had mentioned the book - “Measure What Matters“ by an author John Doerr. Later on, I stumbled on one of his talks at Stanford GSB (2013), and got to know that he is one of the most astute and experienced Venture Capitalist, having worked decades in venture investing, with KPCB, and has made some exceptional investments in companies like Google, Slack, Twitter.

One of the core reasons why venture investing has always intrigued me is because intrinsically as a person, I enjoy the process of thinking, and VC enabled me to understand different business models and products in greater depth. It’s an excellent place to be if one wants to get a broad view of different industries, and interact with founders day in and day out. It puts you in a generalist role, where you can witness their journeys, ups and downs very closely, and understand what it takes to build a good long-lasting firm.

I have gone through 2 long phases of not working/ unemployment, trying to knock on every VC’s door (virtually), sharing my resume and portfolio of work, promising to create good contribution capital for the firm, and requesting an internship or full-time position. I gave ~ 20-25 interviews in each phase and went through a lot of applications and rejections. In hindsight, I feel the overall experience was really grounding, I got to spend a lot of time with myself, created a bunch of investment memos, and improved my interviewing and presentation style. I started liking the excitement of learning something cool, something new every day and really got comfortable (maybe addicted) to doing literally nothing and keeping my mind empty most of the time (something I miss nowadays).

Choosing PeerCapital: Standing out in a sea of “just another fund“

I didn’t apply to PeerCapital, at least not directly, I had applied to another VC, who had closed their hiring, but they liked my profile, so referred me to a founder, Rohit, who had co-founded and scaled CloudNine Hospitals, and was now hiring for his newly launched fund, Capier Investments (now PeerCapital).

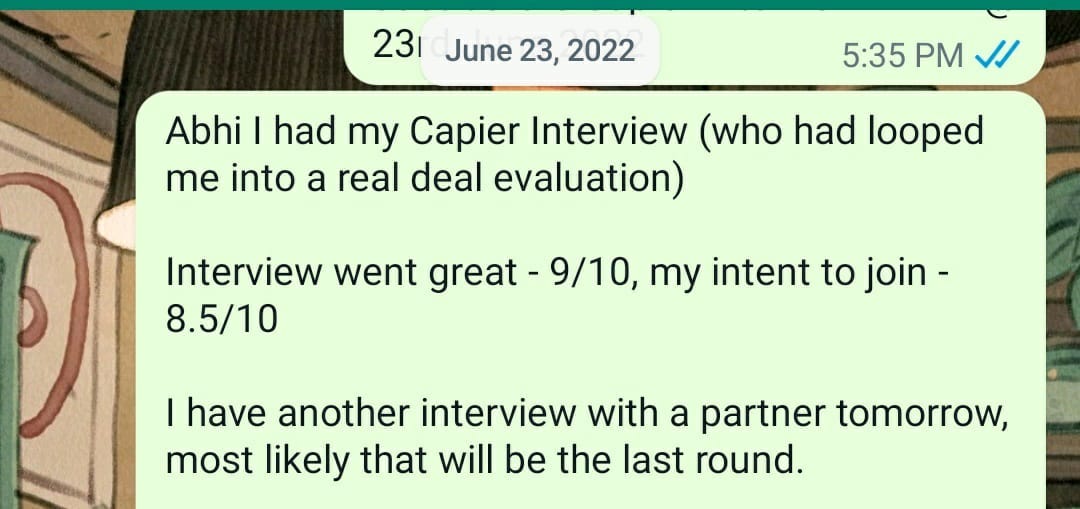

Initially, when I used to interview with VCs in 2021, I would generally rate myself on a scale of 1-10, with how well I felt I performed. By 2022, because I had interacted with so many investors, I also started rating my intent to join that particular fund (basis how well the conversation went by, how comfortable I was speaking to them, and did the vibe match), that I was interviewing with. While most of the funds were in the range of 7-8/10 w.r.t. intent to join, I starkly remember, PeerCapital stood out with a score of 8.5/10.

There are multiple reasons why I felt that. Firstly, when I had my interaction with Rohit, I vividly remember that he was extremely positive, eager to know about me and my experiences, and very enthusiastically shared how he wanted to set up this venture firm as a long-term institution, his energy and optimism were extremely contagious. Then they got me in a real-deal evaluation, looping me in a founder conversation, for a company they were seeing at that moment, and I got to experience how they interact with founders, and most importantly, how they think and view businesses. This is where I got introduced to the second Partner, Ankur, and I was really impressed to see the quality of questions, long-term point of view and second-order thinking, he brought to the discussion.

Most of the other VCs I was interviewing, had some portfolio, past history of making and scaling those investments, for me to assess them, but here was a fund, which was just starting up. Therefore, I wanted to build deeper conviction on PeerCapital, which was basically just these 2 folks at that time. I spoke to dozens of founders, operators and VC investors, to understand how their experience had been with these partners, and whether I should consider joining a new fund. Almost everyone I spoke to, had interacted with either or both Rohit and Ankur, and shared really positive feedback about them, which strengthened my comfort on PeerCapital.

Coincidentally, I signed my offer letter on the same day as my b’day, came to Bangalore in late July 2022, and officially joined the fund on 1st Aug 2022. Within the same week, I got to know, that we had a third Partner joining us, Karthik, someone who I had interviewed with in 2021, back when he was at Chiratae Ventures, felt like massive serendipity, and a great opportunity to work alongside someone who has been a career VC and seen this industry very closely.

Venture Unveiled: A year of shifting mindset and reshaping perceptions

During 2020-2022, I had built the muscle to go deep into businesses and used to spend a lot of time creating in-depth investment memos, maybe because I wasn’t working anywhere, so I had all the time to myself. Most of the companies that I would work on were in the growth/late stage, so I got really used to building points of view on top of past operational and financial data. This became challenging once I joined PeerCapital, as we come at Seed /Pre Series A stage and have to make investment decisions with very limited data points. Therefore, I had to rewire myself to build a sense of comfort around this ambiguity and be able to make a decision despite the lack of information. I’m still developing that sense of maturity to identify, to what extent should I do secondary research, when to have primary conversations, and when to stop the evaluation and strictly take a point of view.

When I was trying to create my own early-stage startup recommendations or a theoretical investment portfolio, one big thing that I could never have imagined was creating the right to win a deal. In theory, you can make whichever investments you want, but in the real world, you have to fight to get deals, and you have to fight harder to get great deals. Even more so at the early stage, because the competition is extremely stiff, there’s a lot of capital available at the Seed/ Series A stage, and every fund (new and old, big and small) is gunning for these great founders. Another big realization was that as hard as it may seem to get into a deal, getting out and returning the money to your LPs is way harder and a much more difficult piece to execute, which makes DPI (Distributed to Paid-In Capital) a critical metric to measure.

When I joined the fund, I used to play to my core intrinsic motivation, i.e. going deep into businesses, and in the initial 6-7 months, I over-indexed on the depth of evaluation and building a deeper understanding of segments. I wouldn’t really think too much about finding companies and building relationships with other VCs. However, recently in the last 3-4 months, I have realized how quintessential sourcing is, to the extent that I now feel that sourcing is one of the most critical, non-incremental levers for an early-stage fund. Now, I see myself spending a lot more time and energy in identifying good companies, and moreover striving to make this process smarter and more efficient.

Additionally, in the last 1 year, I have found myself saying “I wish we could take this forward“, for a lot of companies that I really liked, but we couldn’t because of multiple reasons, maybe the valuation is too high for us, or it’s super early without any kind of proof points, sometimes the round construct doesn’t fit within our swimlanes or we feel the market size itself is too small. All these instances have made me realize one thing, there is a difference between a good company and a good deal, In a lot of such instances, where I wish we had invested and later we don’t, most of them are often good businesses, with solid founders, who are extremely resilient, trying to create inroads into something difficult.

Thanks a lot for reading it :)

See you folks !